ASX Small Caps and IPO Weekly Wrap: Markets lift 1.5pc, while JBY smashes it on debut

- Benchmark rounds up the win on a +1.5% high.

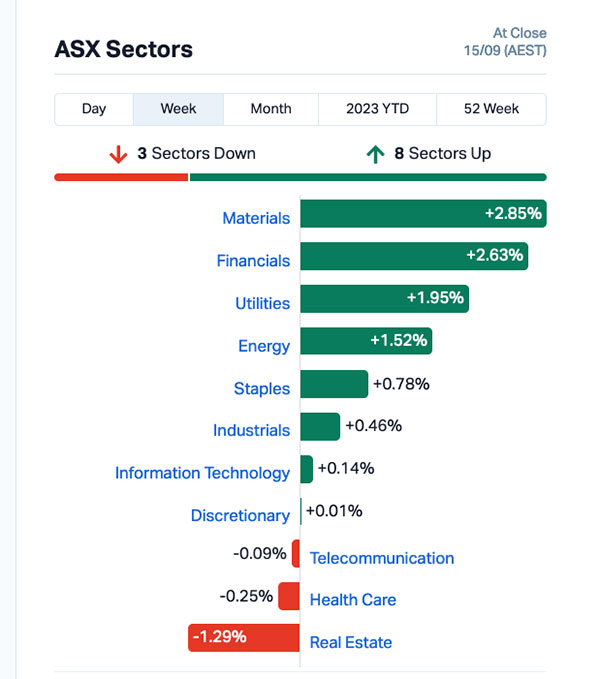

- Stellar week for Materials, Financials, Utilities and Energy. Everything else a bit crap.

- James Bay Minerals (ASX:JBY) proves there’s no such thing as a bad time to IPO.

It’s definitely been a week since the market opened on Monday morning, and it’s lovely to be able to report that the ASX 200 benchmark is heading into the weekend with a spring in its step and gleam in its eye, a healthy 1.5% higher for the week after a solid charge today.

The four leading lights across the sectors this week have been the hard-working Materials, Financials, Utilities and Energy camps, each of them at least 1.0% higher with the top 3 well above +2.0%.

Hardly surprising, then, that the ASX’s own XGD All Ords Gold index was out in front again this week, up 3.21% because of the relentless drive of instability throughout the markets for the past few months.

Or years. It’s really getting hard to tell.

The XJR ASX 200 Resources index, of course, fared well this week, upping its game by 3.17% while the Banks did their usual “slow-n-steady wins the race” trick to quietly bank a 2.85% rise for the week.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks from 11-14 September:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| OZM | Ozaurum Resources | 0.095 | 138% | $4,064,000 |

| AVW | Avira Resources Ltd | 0.002 | 100% | $2,133,790 |

| DXN | DXN Limited | 0.002 | 100% | $3,446,680 |

| MTL | Mantle Minerals Ltd | 0.002 | 100% | $12,294,892 |

| ESK | Etherstack PLC | 0.36 | 80% | $40,844,671 |

| ICN | Icon Energy Limited | 0.007 | 75% | $5,376,096 |

| SI6 | SI6 Metals Limited | 0.01 | 67% | $15,950,875 |

| ELE | Elmore Ltd | 0.006 | 50% | $8,396,303 |

| TD1 | Tali Digital Limited | 0.0015 | 50% | $4,942,733 |

| IXR | Ionic Rare Earths | 0.028 | 47% | $106,544,833 |

| SPD | Southern Palladium | 0.49 | 46% | $20,677,597 |

| ODM | Odin Metals Limited | 0.026 | 44% | $19,477,175 |

| LV1 | Live Verdure Ltd | 0.25 | 43% | $23,337,355 |

| ZEU | Zeus Resources Ltd | 0.0185 | 42% | $8,267,058 |

| TMR | Tempus Resources Ltd | 0.024 | 41% | $7,484,118 |

| BNR | Bulletin Res Ltd | 0.077 | 40% | $17,615,466 |

| EEL | Enrg Elements Ltd | 0.007 | 40% | $6,059,790 |

| EXT | Excite Technology | 0.007 | 40% | $8,114,692 |

| T92 | Terra Uranium | 0.14 | 40% | $6,450,645 |

| GTR | Gti Energy Ltd | 0.011 | 38% | $16,359,577 |

| CNW | Cirrus Net Hold Ltd | 0.056 | 37% | $52,080,358 |

| SPX | Spenda Limited | 0.0095 | 36% | $36,714,222 |

| SRJ | SRJ Technologies | 0.081 | 35% | $9,544,002 |

| INV | Investsmart Group | 0.175 | 35% | $24,713,360 |

| RB6 | Rubix Resources | 0.275 | 34% | $14,728,500 |

| KNM | Kneomedia Limited | 0.004 | 33% | $6,019,141 |

| NAE | New Age Exploration | 0.008 | 33% | $12,923,090 |

| NIS | Nickel Search | 0.048 | 33% | $4,398,997 |

| OKR | Okapi Resources | 0.12 | 33% | $22,059,032 |

| OMX | Orangeminerals | 0.04 | 33% | $1,986,695 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| PEB | Pacific Edge | 0.12 | 33% | $89,178,882 |

| REC | Rechargemetals | 0.265 | 33% | $25,868,196 |

| ASW | Advanced Share Ltd | 0.165 | 32% | $32,879,322 |

| NYM | Narryer Metals | 0.145 | 32% | $4,989,000 |

| RR1 | Reach Resources Ltd | 0.0145 | 32% | $41,015,658 |

| MHI | Merchant House | 0.05 | 32% | $4,713,325 |

| ZEO | Zeotech Limited | 0.056 | 30% | $88,707,999 |

| SKY | SKY Metals Ltd | 0.052 | 30% | $23,182,397 |

| ARR | American Rare Earths | 0.155 | 29% | $58,035,029 |

| 1AE | Aurora Energy Metals | 0.09 | 29% | $13,054,968 |

| GLA | Gladiator Resources | 0.018 | 29% | $10,043,546 |

| RMX | Red Mountain Mining | 0.0045 | 29% | $10,694,304 |

| AW1 | American West Metals | 0.265 | 26% | $85,018,647 |

| AUG | Augustus Minerals | 0.22 | 26% | $16,324,000 |

| AHK | Ark Mines Limited | 0.225 | 25% | $11,060,466 |

| AQI | Alicanto Min Ltd | 0.045 | 25% | $23,287,799 |

| BPP | Babylon Pump & Power | 0.005 | 25% | $11,079,346 |

| CTN | Catalina Resources | 0.005 | 25% | $6,192,434 |

| MRD | Mount Ridley Mines | 0.0025 | 25% | $15,569,766 |

| NGS | NGS Ltd | 0.015 | 25% | $4,019,638 |

| OPN | Oppen Negotiation | 0.01 | 25% | $11,166,796 |

| UVA | Uvre | 0.15 | 25% | $4,904,734 |

| AGE | Alligator Energy | 0.066 | 25% | $218,190,650 |

The hands-down standout for the week is OzAurum, which stacked on around 138% – almost all of it during Friday’s session – after it told the market that its shopping trip to Brazil has been wildly successful.

OZM was flying hard right from open on news that the company has snapped up the Linopolis Jaime Project – a strategically held area of over 20 Lithium-Cesium-Tantalum (LCT) bearing pegmatites that have been mined intermittently for tantalite, beryl, tourmaline, brazilianite and feldspar intermittently by the Pacheco family and other artisanal miners for over 50 years.

OZM wants the spot for its lithium, as it boasts spodumene grades of up to 7.36% LiO2 with an average spodumene grade of 6.94% LiO2 confirmed within a +7m wide spodumene zone.

Them’s big grades.

Etherstack (ASX:ESK) also enjoyed some time in the spotlight this week, up 80% for the week to reach $0.36 per share, after a pretty handy couple of days in the wake of an agreement with Telstra to trial and evaluate Etherstack’s innovative Mission Critical (MCX) 3GPP standards compliant Interworking function.

Ionic Rare Earths (ASX:IXR) pumped 47% this week after executing landmark partnership agreements with Ford, Less Common Metals and the British Geological Society to create a UK-based REE supply chain from recycled magnets.

According to IXR, being able to recycle waste permanent magnets will help alleviate the projected deficit for MREOs as the market grows from the current US$3bn to US$15bn by the end of the decade.

Southern Palladium (ASX:SPD) did well, too – up 46% even though we’ve barely heard a word from the company in the past few months.

On the wrong side of the line, Firebrick Pharma (ASX:FRE) had a shocker, falling 81% when it revealed that its highly-anticipated treatment for the common cold “doesn’t work”.

And AMA Group (ASX:AMA) also had a difficult week. After a few challenging months, a lengthy trading halt and a broom through the boardroom, AMA came out of the trading halt and promptly fell 58%.

ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks from 11-14 September:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| OZM | Ozaurum Resources | 0.095 | 138% | $4,064,000 |

| AVW | Avira Resources Ltd | 0.002 | 100% | $2,133,790 |

| DXN | DXN Limited | 0.002 | 100% | $3,446,680 |

| MTL | Mantle Minerals Ltd | 0.002 | 100% | $12,294,892 |

| ESK | Etherstack PLC | 0.36 | 80% | $40,844,671 |

| ICN | Icon Energy Limited | 0.007 | 75% | $5,376,096 |

| SI6 | SI6 Metals Limited | 0.01 | 67% | $15,950,875 |

| ELE | Elmore Ltd | 0.006 | 50% | $8,396,303 |

| TD1 | Tali Digital Limited | 0.0015 | 50% | $4,942,733 |

| IXR | Ionic Rare Earths | 0.028 | 47% | $106,544,833 |

| SPD | Southern Palladium | 0.49 | 46% | $20,677,597 |

| ODM | Odin Metals Limited | 0.026 | 44% | $19,477,175 |

| LV1 | Live Verdure Ltd | 0.25 | 43% | $23,337,355 |

| ZEU | Zeus Resources Ltd | 0.0185 | 42% | $8,267,058 |

| TMR | Tempus Resources Ltd | 0.024 | 41% | $7,484,118 |

| BNR | Bulletin Res Ltd | 0.077 | 40% | $17,615,466 |

| EEL | Enrg Elements Ltd | 0.007 | 40% | $6,059,790 |

| EXT | Excite Technology | 0.007 | 40% | $8,114,692 |

| T92 | Terra Uranium | 0.14 | 40% | $6,450,645 |

| GTR | Gti Energy Ltd | 0.011 | 38% | $16,359,577 |

| CNW | Cirrus Net Hold Ltd | 0.056 | 37% | $52,080,358 |

| SPX | Spenda Limited | 0.0095 | 36% | $36,714,222 |

| SRJ | SRJ Technologies | 0.081 | 35% | $9,544,002 |

| INV | Investsmart Group | 0.175 | 35% | $24,713,360 |

| RB6 | Rubix Resources | 0.275 | 34% | $14,728,500 |

| KNM | Kneomedia Limited | 0.004 | 33% | $6,019,141 |

| NAE | New Age Exploration | 0.008 | 33% | $12,923,090 |

| NIS | Nickel Search | 0.048 | 33% | $4,398,997 |

| OKR | Okapi Resources | 0.12 | 33% | $22,059,032 |

| OMX | Orangeminerals | 0.04 | 33% | $1,986,695 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| PEB | Pacific Edge | 0.12 | 33% | $89,178,882 |

| REC | Rechargemetals | 0.265 | 33% | $25,868,196 |

| ASW | Advanced Share Ltd | 0.165 | 32% | $32,879,322 |

| NYM | Narryer Metals | 0.145 | 32% | $4,989,000 |

| RR1 | Reach Resources Ltd | 0.0145 | 32% | $41,015,658 |

| MHI | Merchant House | 0.05 | 32% | $4,713,325 |

| ZEO | Zeotech Limited | 0.056 | 30% | $88,707,999 |

| SKY | SKY Metals Ltd | 0.052 | 30% | $23,182,397 |

| ARR | American Rare Earths | 0.155 | 29% | $58,035,029 |

| 1AE | Aurora Energy Metals | 0.09 | 29% | $13,054,968 |

| GLA | Gladiator Resources | 0.018 | 29% | $10,043,546 |

| RMX | Red Mountain Mining | 0.0045 | 29% | $10,694,304 |

| AW1 | American West Metals | 0.265 | 26% | $85,018,647 |

| AUG | Augustus Minerals | 0.22 | 26% | $16,324,000 |

| AHK | Ark Mines Limited | 0.225 | 25% | $11,060,466 |

| AQI | Alicanto Min Ltd | 0.045 | 25% | $23,287,799 |

| BPP | Babylon Pump & Power | 0.005 | 25% | $11,079,346 |

| CTN | Catalina Resources | 0.005 | 25% | $6,192,434 |

| MRD | Mount Ridley Mines | 0.0025 | 25% | $15,569,766 |

| NGS | NGS Ltd | 0.015 | 25% | $4,019,638 |

| OPN | Oppen Negotiation | 0.01 | 25% | $11,166,796 |

| UVA | Uvre | 0.15 | 25% | $4,904,734 |

| AGE | Alligator Energy | 0.066 | 25% | $218,190,650 |

HOW THE WEEK PLAYED OUT

Monday, 11 September – ASX 200 Up 0.36%

Novo Resources (ASX:NVO) ended flat after it jumped as high as 38%% on its market debut – shares were listed at 20c and traders got in and got out by the close.

After raising $7.5m to join the ASX, Canadian gold miner Novo Resources sits Smaug-like atop one of the largest prospective tenures for gold and battery metals in WA’s Pilbara region for 10,500km2 and is concentrating on the development of its Egina JV with its biggest shareholder, De Grey Mining (ASX:DEG) .

Back in June, De Grey Mining made a cornerstone investment of $35m to earn up to a 50% interest in Novo’s Becher gold project, 28km away from DEG’s massive Hemi gold deposit which forms part of the 11.7Moz Mallina gold project. In Victoria, Novo also owns the Belltopper project.

Cirrus Networks (ASX:CNW), wadded 30% on news that it’s entered into a Scheme Implementation Deed under which it is proposed Atturra will acquire 100% of Cirrus for $0.053 per share.

Octava Minerals (ASX:OCT) now owns 100% of its Talga lithium project in the WA Pilbara after purchasing the remaining 30% from First Au (ASX:FAU).

This includes a 20% free carried interest held by FAU to a decision to mine via a $200,000 cash payment, the issue of 1.25 million shares to FAU to be escrowed for six months, and a 0.75% net smelter royalty. Octava shot up 27% in early trade, but settled lower in arvo trade.

Octava says the geology of its tenure is similar to the nearby 18Mt @ 1% Li2O Archer lithium deposit held by Global Lithium Resources (ASX:GL1) and has significant gold prospects to boot.

Elsewhere, Orange Minerals (ASX:OMX) was up over 32% on no news, and Australian Critical Minerals (ASX:ACM) also rose sharply up 18%, on nothing other than evidently being terrific companies on Monday.

Tuesday, 12 September – ASX 200 Up 0.2%%

Debutante James Bay Minerals (ASX:JBY) announced itself as a significant new name in lithium, rising strongly on its first day on the ASX and bringing with it one of the largest exploration portfolios in Canada’s prolific James Bay lithium district.

Totalling ~224km2, the company’s Joule, Aero and Aqua properties are located in the ‘La Grande’ sub-province, along trend from the Corvette deposit, where Patriot Battery Metals (ASX:PMT) has an inferred MRE of 109.2Mt @ 1.42% Li2O and 160ppm Ta2O5.

The Troilus project is further to the south, only 5km north of Sayona Mining’s (ASX:SYA) Moblan lithium project and near Winsome Resources’ (ASX:WR1) Sirmac-Clappier project.

Everyone loves a comeback story, and as I write the COVID-era anti-bacteria maker Zoono Group (ASX:ZNO) is pulling off a bit of a one, up 25% to 4.5 cents round lunchtime, hitting +38% by the end of play.

ZNO is a local biotech which makes and sells super-dooper, inhouse ‘scientifically-proven, environmentally-friendly anti-microbial solutions’ which come in the guise of various sprays, wipes and foams – suited for skin care, surface sanitisers, food wraps and the lot.

But it was NickelSearch (ASX:NIS), that owned Tuesday, when the nickel-now-lithium aspirant jumped on news of a collaboration with Allkem (ASX:AKE), owner and operator of the Mt Cattlin lithium mine, 10km from the Carlingup Nickel Project.

Under the terms Allkem will review the lithium-related data for Carlingup and advise on target generation and prioritisation.

“The arrangement is not yet at the level of a formal lithium joint venture and there is no guarantee that the technical collaboration will lead to a formal agreement in the future,” NickelSearch says.

Odin Metals (ASX:ODM) rose throughout the day on news that Martin Donohue, founder and former CEO of Kidman Resources (since de-listed and operating as Australian Light Minerals), is now non-executive chairman of the company, effective immediately.

Donohue is a big name in Aussie business, mining and also regarding China’s predatory approach during the mining boom, among old China Hands.

Simon Peters will assume the role of CEO/managing director as a result of this appointment, Odin says.

Wednesday, 13 September – ASX 200 Down 0.74%

Shares in naughty metals explorer Tempus Resources (ASX:TMR) absolutely surged, jumping almost 50% in the space of a few hours this morning on a distinct lack of news, before the ASX Highway cops steeped in, took them down and the shares were placed in restraining cuffs and put in a halt.

Tempus’ has gold exploration licences in Canada as well as some gold and copper prospects in Ecuador. The stock had shed almost its own bodyweight since clocking an all-time weigh-in high of 37¢ back in late 2020.

Shares were last traded at 2.4¢.

Pental (ASX:PTL) has made some bold moves since popping out of its own Trading Halt, the home, hygiene and e-commerce product developer and supplier is offloading its Consumer Products Business and a great big factory in beautiful Shepparton to none other than Selley’s, which some of you may recall is in the paints ‘n stuff business as part of Dulux Group.

The sale price is a cool $60m and comes with an exciting payout for punters:

- A fully franked special dividend ‘of up to approximately 6 cents per share expected to be paid on or around 15 December 2023

- An intended capital return ‘of up to approximately 18 cents per share (aggregate of $30.7

million) subject to shareholder approval at Pental’s 2023 annual general meeting and tax

advice (expected to be paid on or around 15 December 2023); - And an additional fully franked special dividend ‘of up to approximately 7 cents per share

(aggregate of $11.9 million) to be paid 8 months after completion of the Proposed Transaction.’

And that’ll be in addition to Pental’s otherwise enormous fully franked dividend of 1 cent per share

Unsurprisingly, Pental’s directors unanimously recommend that Pental shareholders vote in favour of the sale, in the absence of a better offer – it was up 40% near the close.

James Bay Minerals (ASX:JBY) is finding life as a listed concern a piece of lithium pie. On day 2 the Canada-facing lithium explorer is doing what it did yesterday, climbing unsteadily, but definitely climbing – it’s up circa 28% near the close now almost double it’s $0.20 listing price.

Starpharma (ASX:SPL) is up over 22% on news that interim data from the phase 1/2 clinical trial of DEP irinotecan shows that the drug prompts durable responses for up to 72 weeks in CRC patients receiving DEP irinotecan monotherapy, with a disease control rate (DCR) of 48%.

The clinical data was obtained from heavily pre-treated, advanced metastatic colorectal cancer (CRC) or platinum-resistant/refractory ovarian cancer patients. and will be presented at an upcoming key international oncology conference.

Additionally, SPL says the data shows a 100% disease control rate in patients receiving DEP irinotecan in combination with 5-fluorouracil (5-FU) and leucovorin (LV).

Thursday, 14 September – ASX 200 Up 0.46%

Okapi Resources (ASX:OKR) jumped almost up 30% on this uranium business.

OKR is an Australian minerals exploration company focused in the Kimberley Goldfields of Western Australia and the Democratic Republic Congo (DRC).

But it’s long-term strategy to become ‘a new leader in North American carbon-free nuclear energy’ by developing its portfolio of top notch uranium assets, is what’s led to today’s mighty stride.

Okapi’s case for developing uranium projects in North America reduces to several converging factors:

- the clean energy movement will have to embrace nuclear power

- uranium supply is not sufficient to meet future demand, and

- the USA is investing billions in reigniting its nuclear energy capabilities and along with it, domestic uranium supply.

Okapi’s wave today is basically No #2 – the increasingly positive outlook for uranium demand which has driven the price to decade highs, after the World Nuclear Association released its forecasts for 2023 through to 2040.

But Okapi has strong strategic positions in #3) as well, more specifically in North America’s most prolific uranium districts – the Tallahassee Creek Uranium District in Colorado, and Canada’s Athabasca Basin, which currently supplies about 20% of the world’s uranium. In the US, our flagship Tallahassee Uranium Project in Colorado has a JORC Resource of 49.8Mlbs U3O8 (average grade of 540ppm U3O8).

Okapi also has the high-grade Rattler Uranium Project in Utah, and the Maybell Uranium Project in Colorado which boasts historical production of 5.3 million pounds of U308 (average grade 1,300ppm).

Terra Uranium (ASX:T92) another Aussie uranium explorer is leading the daily resources pack with a roughly 28% gain.

Terra is focused on exploring for heavy metal in Canada’s Athabasca Basin and it’s been particularly encouraged by the results from its first hole drilled at its Parker Lake project where it recently turned up a peak grade of 32.5 parts per million over 0.2 metres in diamond drilling.

Terra Uranium Executive Chairman, Andrew Vigar commented on this about a week ago with:

“The presence of anomalous uranium and pathfinders in our first drill hole at Parker is very encouraging and bears similarities to that recently reported from IsoEnergy’s Hawk Project on the Cable Bay Shear Zone 40km to the north east.

“We have only just begun to orient ourselves on this fertile structure, having brought all the scientific data up to modern standards suitable for targeting of a major uranium discovery in this new domain”.

Mini-cap oil and gas hunter Metgasco (ASX:MEL) has jumped over 30% this afternoon.

The minnow has long held licences out in South Australia’s Cooper Basin gas riches and it says it’s finally kicked into production out of the Odin-1 gas well at its joint venture project.

Friday, 15 September – ASX 200 Up 1.3%

Friday was all about Ozaurum Resources (ASX:OZM), which was flying hard right from open this morning, on news that the company has snapped up the Linopolis Jaime Project – a strategically held area of over 20 Lithium-Cesium-Tantalum (LCT) bearing pegmatites that have been mined intermittently for tantalite, beryl, tourmaline, brazilianite and feldspar intermittently by the Pacheco family and other artisanal miners for over 50 years.

CEO and Managing Director, Andrew Pumphrey:

“We believe this is an ideal opportunity for the company to acquire strategic lithium projects in addition to the Mulgabbie and Patricia Gold Projects in Western Australia.

“In particular, the advanced Jaime Linopolis lithium Project with a +7m wide spodumene zone with an average grade of spodumene crystals of 6.94% LiO2 offers an immediate drill target and potential for a new lithium discovery,” Pumphrey said.

I might even repeat that bit: spodumene grades of up to 7.36% LiO2 with an average spodumene grade of 6.94% LiO2 confirmed within a +7m wide spodumene zone.

Thiccer than oatmeal, as my impossibly white teenage son says.

Also keeping up the good work was Future Battery Minerals (ASX:FBM) up on news that the company has received firm commitments for a heavily oversubscribed $7.6 million placement, including dollars coming in from some Big Names like Hancock Prospecting.

FBM says it’s going to spend the money on speeding up exploration drilling at the Kangaroo Hills Lithium Project (KHLP) in WA, in which the recent Phase 3 drilling has confirmed a significant spodumene bearing pegmatite swarm at the Big Red and Rocky prospects.

Finally, Adavale Resources (ASX:ADD) had a terrific General Meeting last night. They published the results of the resolutions put to members, advising that “all resolutions proposed were passed on a poll and without amendment.”

They also placed a bunch of shares, and climbed circa 23%.

IPO listings this week

Listing: 12 September, 2023

IPO: $6.0m at $0.20 per share

James Bay hit the ground running this week, helping to reignite the market’s passion for lithium and proving that it’s possible to run a successful IPO at a time when pretty much everybody within screaming distance is questioning your sanity.

On the morning it went live, it opened at $0.25 and is currently sitting at $0.475 at the close of its first week on market, up a handsome 137.5%.

Listing: 11 September, 2023

IPO: $7.5 million at $0.20 per share

Novo listed this week to leverage its ownership of a highly prospective 10,500 km2 Pilbara, Western Australia, exploration portfolio, with a strong focus on the Nunyerry and Balla Balla Projects – both located in the East Pilbara – into something special.

While not as impressive as JBY’s rise, NVO did come to the end of the week ahead of the game, closing at $0.22 – up 10% since launch.

Upcoming IPOs

CGN Resources (CGR) – Due to list on September 15, $10 million at $0.20

Pioneer Lithium (PLN) – Due to list on September 18, $5 million at $0.20

Far Northern Resources (FNR) – Due to list on September 21, $6 million at $0.20

The post ASX Small Caps and IPO Weekly Wrap: Markets lift 1.5pc, while JBY smashes it on debut appeared first on Stockhead.